China dominates rare earth minerals, vital for tech. But changing demand patterns offer a chance for the US and others to diversify supply chains.

For years, the United States and other nations have been keenly aware of China’s commanding position in the global supply of rare earth elements. These seventeen elements, despite their name, are relatively abundant but geographically concentrated and crucial for a wide array of modern technologies, from smartphones and electric vehicles to wind turbines and advanced defense systems. This concentration has understandably raised concerns about potential supply disruptions and economic leverage.

However, the landscape might be shifting. The very nature of demand for these critical minerals is evolving, and this could create opportunities for other players to emerge and challenge China’s dominance. It’s not about completely eliminating China’s role, but about fostering a more resilient and diversified global supply chain.

The Power of Evolving Demand

The traditional narrative often focuses on the ever-increasing need for rare earths. While overall demand will likely continue to grow, the specific types of rare earths needed and the way they are utilized are changing. This is driven by several factors:

- Technological Innovation: Researchers and engineers are constantly seeking new materials and designs that require less of certain rare earth elements or can substitute them with more readily available alternatives. For example, advancements in magnet technology might lead to designs that rely less on heavy rare earths, where China’s control is particularly strong.

- The Rise of Recycling: As more products containing rare earths reach their end of life, the potential for recycling these valuable materials increases. Investing in and scaling up rare earth recycling infrastructure in the U.S. and allied nations could significantly reduce our reliance on primary mining and processing.

- Shifting Applications: While permanent magnets remain a significant demand driver, the growth in other sectors and the specific rare earth profiles they require could differ. A greater emphasis on certain clean energy technologies or changes in defense applications could alter the demand balance.

Opportunities for the United States and Allies

This evolving demand landscape presents a significant window of opportunity for the United States and its allies to strengthen their own rare earth supply chains. This can be achieved through a multi-pronged approach:

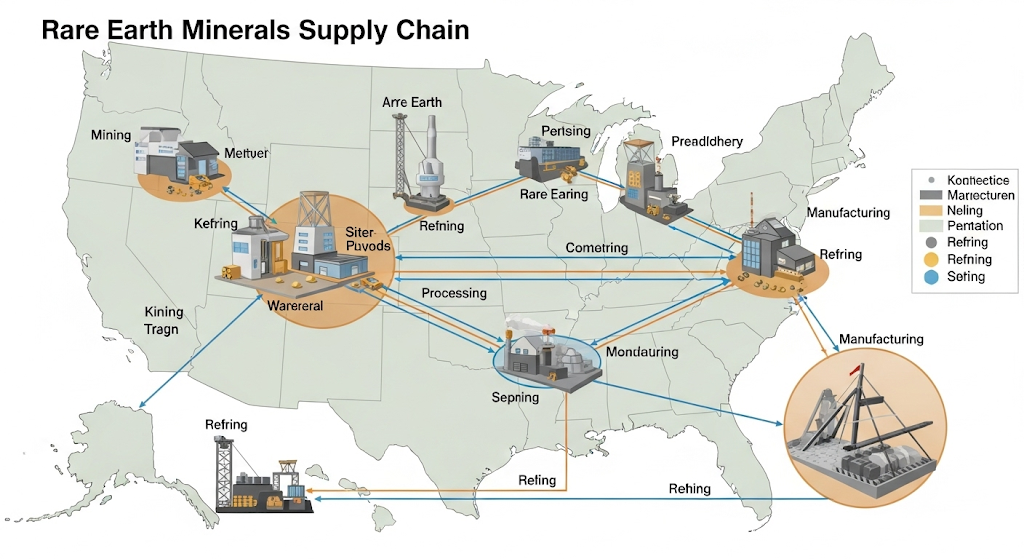

- Investing in Domestic Mining and Processing: While environmentally responsible mining and processing can be challenging, strategic investment in these areas within the U.S. and in collaboration with trusted partners can reduce dependence on a single dominant source.

- Fostering Innovation in Material Science: Supporting research and development into alternative materials and more efficient use of existing rare earths is crucial for long-term resilience.

- Building Robust Recycling Infrastructure: Creating a comprehensive system for collecting, processing, and reusing rare earth-containing products can significantly offset the need for newly mined materials.

- Strengthening International Partnerships: Collaborating with other nations that have rare earth resources or processing capabilities can create a more diverse and secure global supply network.

A More Balanced Future

The path to a more balanced rare earth market won’t be immediate or easy. China has invested heavily in this sector for decades and possesses significant expertise and infrastructure. However, by understanding and leveraging the shifts in demand, the United States and its allies can take meaningful steps towards reducing their reliance and building a more secure and resilient future for these critical materials. This isn’t just about economic security; it’s also about ensuring access to the essential building blocks of the technologies that will drive our future.